Real Estate Investing For Starters

Real-estate investment is definitely an outstanding way to expand your revenue flow, before scuba diving in it's essential to carefully think about numerous features like schooling, time, relationships and assurance.

Put real-estate purchases for your expenditure stock portfolio for many benefits. They may branch out and decrease dangers.

Purchasing a Home

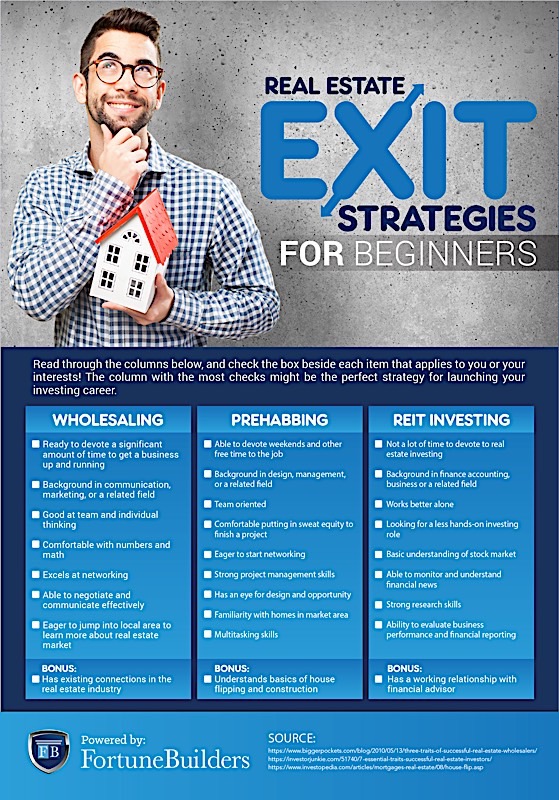

Beginners in real property making an investment should turn out to be acquainted with their possibilities as well as the different methods for house wholesale commencing. There are numerous types of property expense prospects, which include acquiring or booking properties in addition to investing in REITs every single may need much more operate depending on its complexness, but each one is best ways to begin property purchase.House buying for real-estate expense is probably the simplest and the majority of powerful techniques accessible to residence traders. By browsing out attributes suited to reconstruction with your community at discount prices, purchasing them and remodeling them quickly you may key in real estate property expenditure without running into large down repayments or maintenance fees. When looking for properties to buy it's also intelligent to contemplate your target audience: as an illustration concentrating on houses near excellent institution districts or parks might help narrow your focus substantially.

Turnkey leasing qualities provide another method of buying real estate property. These one-family and multifamily residences have been remodeled by a smart investment residence firm and therefore are completely ready for rental, causeing this to be method of real-estate obtain suitable for novices without having the sources to fix up components them selves.

Real estate making an investment for beginners provides many desirable benefits, one simply being its capability to create cashflow. This refers back to the world wide web revenue after mortgage payments and working bills have already been subtracted - it will also help deal with mortgage repayments when reducing taxes thanks.

REITs and crowdfunding offer you two workable purchase options for newbies seeking to get into real-estate, respectively. REITs are real-estate expenditure trusts (REITs) dealt on inventory swaps that very own and manage real estate attributes these REITs give a secure strategy for diversifying your collection whilst assisting to satisfy financial goals more rapidly than other types of committing. Moreover, their prices are available for relatively modest amounts of cash producing REITs a perfect way to start off investing for beginners.

Buying a Commercial House

When selecting industrial property, traders should keep in mind that this type of purchase can vary drastically from investing in home property. When deciding on where you are and taking into consideration the chance patience and objective for investing, nearby zoning laws and regulations should also be evaluated for instance if using it for company take advantage of this can effect reselling values and also hire possible.In contrast to home real estate property purchases, making an investment in commercial properties involves better hazards and requires comprehensive analysis. They are certainly more intricate with better cash flow needs in comparison to single-loved ones properties additionally, there might be various costs such as financial loan fees, home fees, insurance premiums, maintenance estimates, managing service fees or servicing quotations - these bills can quickly add up therefore it is very important that this skilled evaluates the market before shelling out.

Beginning your employment in business home involves while real estate wholesaling explained using experience of any experienced broker or realtor. They are going to assist in locating a residence that greatest fits your needs and finances, and aid in homework functions as needed. Before investing in a home also, it is important to fully grasp its neighborhood taxes rules implications in addition to understanding how to calculate limit price and cash flow calculations.

You will find six major methods of purchasing real estate: primary investment, REITs, REIGs, property syndication and crowdfunding. Every single way of real estate investment has its own group of positive aspects and difficulties in choosing a single you need to choose if you intend to purchase/turn/handle/outsource the task.

As being a beginner in actual estate committing, a smart technique could be to get started on by utilizing pre-existing equity as leveraging. This method saves both money and time since it removes the hassle of getting bargains yourself although offering you contact with industry requirements prior to acquiring your very own properties.

Buying a Lease Home

Among the finest real estate property investing techniques for novices is getting rental attributes. Leasing out home provides an excellent way to generate residual income whilst potentially getting extremely profitable nevertheless, newcomers should understand that buying lease residence might be high-risk endeavor. They should execute a in depth industry and location examination prior to making any last judgements for instance they ought to consider factors like criminal activity costs, institution districts and saturation of stock stock inside their region simply because this will let them avoid losing cash or overpaying for components.Newbies in real real estate expenditure should search for more compact, less hazardous investments like a place to start, for example purchasing a individual-household residence or condominium inside a harmless community. They should seek out components with potential for long-term progress to grow their expenditure portfolio gradually with time.

Understand that property assets call for both commitment to ensure that you deal with. As this is often difficult for commencing traders, it really is vitally important that they have use of a support network made up of residence administrators, lawyers, an accountant, building contractors, and so forth. Additionally, newcomers should participate in as numerous networking occasions as possible to meet other specialists inside their sector and look for their niche.

Lastly, having a in depth plan for every single residence you own is crucial. Doing this will enable you to check funds inflow and outflow relevant to rentals in addition to when it could be beneficial to fix up or upgrade them - ultimately assisting maximize your roi.

Real-estate can feel like a overwhelming obstacle, yet its positive aspects may be large. Not only can property offer you continuous channels of income however it is also a fantastic diversifier for your retirement life bank account, lowering danger by diversifying away from stocks that accident while often pricing under other long term purchases.

Investing in a REIT

REITs offer you investors usage of property while not having to purchase individual attributes, while giving greater results in than conventional repaired earnings ventures including ties. They could be a very good way to branch out a collection nevertheless, investors must ensure they completely grasp any associated risks and choose REITs with recognized monitor records.There are several forms of REITs, each and every with their very own group of distinctive qualities. Some concentrate on mortgage loan-supported securities that could be highly volatile other people individual and control professional real-estate such as places of work or shopping centers still others individual multiple-loved ones leasing apartments and constructed housing. A number of REITs are even publicly exchanged on supply exchanges enabling investors to directly obtain offers other nonpublicly traded REITs may be accessible through private equity money and agents.

When picking a REIT, make certain it includes a eco friendly dividend that aligns with its income history and management group. Also remember the risks concerned for example probable house importance decrease and monthly interest modifications along with its full give back and quarterly benefits in addition to its annual functioning revenue.

REITs typically deliver benefits as everyday cash flow as an alternative to money gains on their traders, which may show useful for anyone in reduced income tax mounting brackets. It's also really worth keeping in mind that REITs may offer you far better options than straight real-estate committing for newcomers to real estate property shelling out.

NerdWallet will help you select an REIT ideal to your expenditure requires by evaluating broker agents and robo-advisors on the internet, taking into consideration fees and minimum requirements, purchase possibilities, customer care features and mobile app capabilities. Once you see 1 you want, REIT purchases can begin remember they're long term ventures which need keeping track of periodically furthermore house loan REIT costs often increase with rising interest rates this tendency can make mortgage REITs especially unstable purchases.