Real Estate Property Investing For Novices

Property expense is surely an excellent way to expand your income source, just before plunging in it's vital that you carefully take into account numerous elements for example schooling, time, contacts and assurance.

Include real estate assets to the purchase portfolio for a lot of pros. They could diversify and reduce risks.

Buying a House

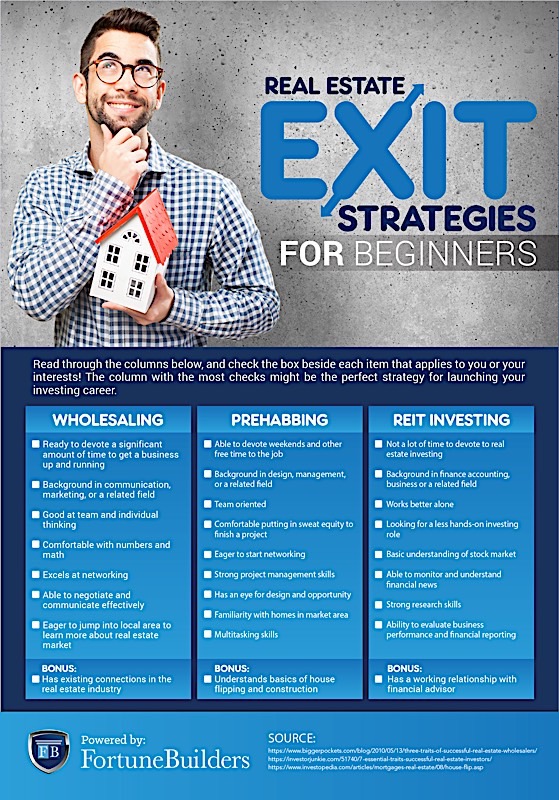

Novices in actual residence investing should come to be knowledgeable about their choices and the different techniques for commencing. There are many kinds of real estate expense opportunities, which includes acquiring or hiring properties in addition to buying REITs every single may need much more function dependant upon how can i invest in real estate its intricacy, but are all best ways to begin real estate property purchase.Residence buying for property investment is probably the quickest and most effective techniques open to property brokers. By browsing out components suitable for renovation within your geographic area at affordable prices, getting them and improving them quickly you may enter in real estate expenditure without experiencing huge down obligations or repair expenses. When looking for qualities to purchase it's also smart to contemplate your target market: for instance focusing on properties near very good college districts or areas might help filter your concentrate substantially.

Turnkey lease attributes provide another way of investing in property. These one-family members and multifamily houses have already been remodeled by an investment residence organization and they are completely ready to rent, which makes this method of property buy well suited for beginners without the sources to fix up attributes themselves.

Real estate property making an investment for novices provides several appealing rewards, 1 simply being its ability to produce income. This refers back to the world wide web income after home loan payments and running expenses have been deducted - it may help cover mortgage payments whilst lowering income taxes due.

REITs and crowdfunding supply two feasible investment options for novices seeking to key in real estate property, correspondingly. REITs are real estate property expenditure trusts (REITs) dealt on supply exchanges that individual and deal with real-estate qualities these REITs supply a harmless means of diversifying your stock portfolio whilst assisting to meet economic objectives faster than other types of shelling out. Moreover, their rates can be acquired for relatively modest amounts of money generating REITs a great approach to begin shelling out for beginners.

Buying a Professional Residence

When purchasing business property, brokers should keep in mind that this form of investment can vary considerably from making an investment in residential real estate. When picking your physical location and with the risk threshold and purpose for investing, nearby zoning laws also needs to be considered for example if working with it for business take advantage of this can influence reselling values along with leasing prospective.Rather than residential real estate ventures, purchasing commercial attributes involves increased dangers and requires considerable analysis. They tend to be complex with better cash flow specifications in comparison with single-family members residences furthermore, there may be numerous costs such as loan charges, property income taxes, insurance premiums, fix quotes, managing service fees or routine maintenance quotations - these bills can quickly mount up therefore it is very important that the skilled evaluates the industry well before shelling out.

Commencing your work in business residence consists of utilizing the expertise of an knowledgeable brokerage or real estate broker. They are going to assist in locating a residence that best meets your requirements and finances, and help with research procedures as needed. Prior to buying a residence additionally it is essential to comprehend its neighborhood tax rules effects along with understanding how to estimate cover price and cashflow calculations.

You will find six major ways of buying real estate: primary expenditure, REITs, REIGs, real-estate syndication and crowdfunding. Every single way of real estate expense features its own group of benefits and difficulties in choosing one you must also make a decision if you intend to acquire/change/control/outsource the project.

Like a novice in real property shelling out, a smart approach can be to start out through the use of present value as make use of. This process helps save both time and cash because it eliminates the irritation of getting offers yourself when supplying you with exposure to sector standards prior to getting your very own qualities.

Investing in a Hire Home

Among the finest real estate shelling out methods for amateurs is purchasing leasing qualities. Hiring out property gives an effective way to generate passive income when potentially being extremely profitable nonetheless, newcomers should understand that buying hire home can be risky venture. They need to conduct a thorough market place and location evaluation before you make any closing selections for example they should consider factors like offense costs, university areas and saturation of products supply within their location since this will permit them to steer clear of losing funds or overpaying for attributes.First-timers in actual residence purchase should seek out smaller sized, more secure investments like a starting place, including buying a one-family property or condo in a risk-free area. They ought to seek out components with possibility of long term progress to expand their expenditure profile gradually after a while.

Understand that property assets call for both time and energy to actually deal with. As this can be tough for beginning buyers, it is truly essential that they have access to a help system made up of property executives, attorneys, an accountant, companies, and so on. Moreover, newcomers should participate in several marketing events as you possibly can to fulfill other specialists with their business and look for their niche market.

Eventually, possessing a detailed prepare for every single property you own is vital. Achieving this will assist you to monitor funds inflow and outflow associated with rental fees as well as when it might be useful to fix up or update them - ultimately assisting increase your return on your investment.

Real-estate can how to wholesale real estate feel such as a overwhelming challenge, yet its rewards can be substantial. Not only can property provide you with continuous channels of revenue however it is also an excellent diversifier for your retirement life account, lowering risk by diversifying from shares that crash whilst often pricing less than other long term ventures.

Getting a REIT

REITs offer you investors usage of real estate property without needing to acquire person properties, while offering increased produces than traditional fixed income investments like connections. They may be an effective way to broaden a portfolio nonetheless, buyers must be sure they fully understand any associated hazards and judge REITs with recognized monitor documents.There are several kinds of REITs, every single because of their own set of special features. Some are experts in house loan-backed securities that may be highly erratic other folks personal and manage professional property like workplaces or shopping centers and others personal multiple-loved ones hire apartments and manufactured property. Particular REITs are even publicly exchanged on inventory swaps enabling traders to directly acquire gives other nonpublicly traded REITs may be accessible through private collateral resources and broker agents.

When deciding on a REIT, guarantee it includes a eco friendly dividend that aligns featuring its earnings past and administration staff. Also take into account the health risks involved including possible home value decline and rate of interest alterations as well as its complete return and quarterly dividends along with its once-a-year running revenue.

REITs typically disperse dividends as regular revenue instead of capital profits to their investors, which may show useful for people in lower tax mounting brackets. It's also really worth keeping in mind that REITs may provide better prospects than straight real-estate making an investment for newcomers to real estate committing.

NerdWallet can help you decide on an REIT suitable for your purchase requires by evaluating brokers and robo-advisors on the internet, considering fees and minimum requirements, expense alternatives, customer service capabilities and mobile app capabilities. Once you find one you prefer, REIT purchases can start just remember they're long term ventures which need tracking periodically in addition mortgage loan REIT costs often climb with soaring rates this tendency tends to make mortgage loan REITs especially erratic assets.